Property Tax Information

Property Tax Information

The County Assessor calculates the property taxes, the Treasurer's Office is responsible for the collection and distributions of them along with any applicable Special District taxes. The Treasurer is required to send tax notices annually, no later than October 10th to the owner on record as of January 1st of that tax year. The notice must be sent in sealed envelopes to the taxpayer at his last known address. If you do not receive a tax bill by the end of October, feel free to call and we would be happy to get you another copy.

Keep in mind, if you do not receive a tax bill, it does not change your obligation to pay your taxes by the due dates. The law makes it clear that failure to send notice or demand payment of taxes does not invalidate any taxes due. Specifically W.S. 39-13-107 (b)(i)(C).

The law states that if the property is conveyed on or after January 1st of the tax year, the seller of the property shall pay the taxes for the year unless there is an agreement in writing specifying otherwise. This is often handled in closing. If you are unsure, contact your closing company to find out who is responsible. However, the tax bill will remain in the seller's name, regardless of who is responsible for the payment.

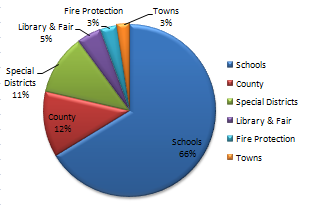

The Treasurer's Office disburses the tax monies to various entities. For every tax dollar collected the county receives approximately 12¢, schools receive approximately 66¢ with the remaining 22¢ going to special districts.

To see the exact distribution of the Platte County Valuation, please download the following spreadsheet: 2024 Platte County Mill Levy Sheet

Contact Information for the Platte County Treasurer's Office - Phone: (307) 322-2092 Fax:(307) 322-1340 Email: krietz@plattecountywyoming.com

Office Hours: 7:00 a.m. - 5:00 p.m. Monday - Friday